Free Email Sign Up to Receive News & Oracle Commodity Holding Chairman Alerts

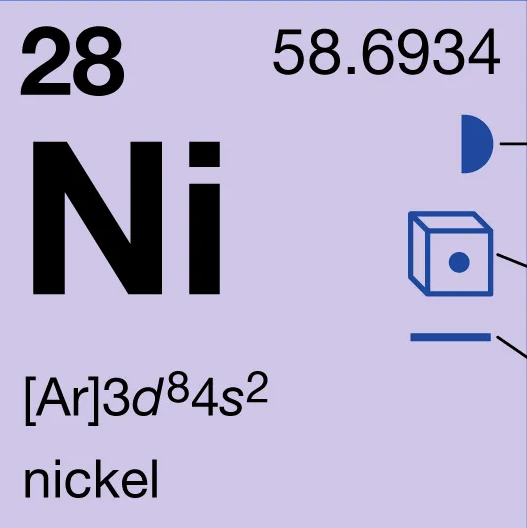

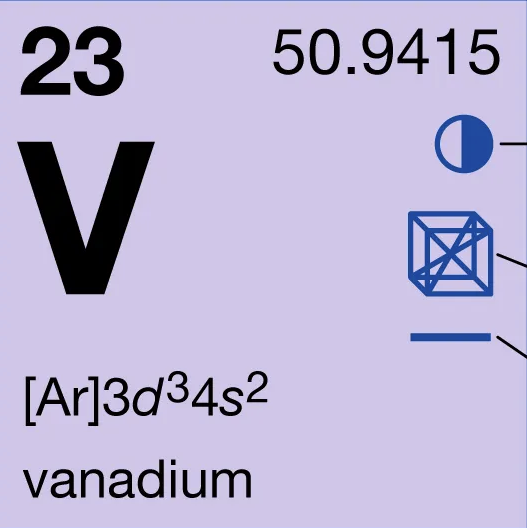

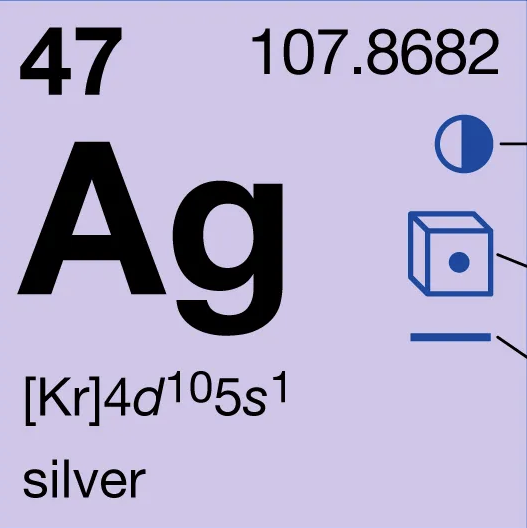

Oracle Commodity Holding Corp. (TSX-V: ORCL, OTCQB: ORLCF),, is a mining royalty and investment company. Oracle is a royalty company with a portfolio of Silver, Nickel, Vanadium, Coal, and Fluorspar properties.

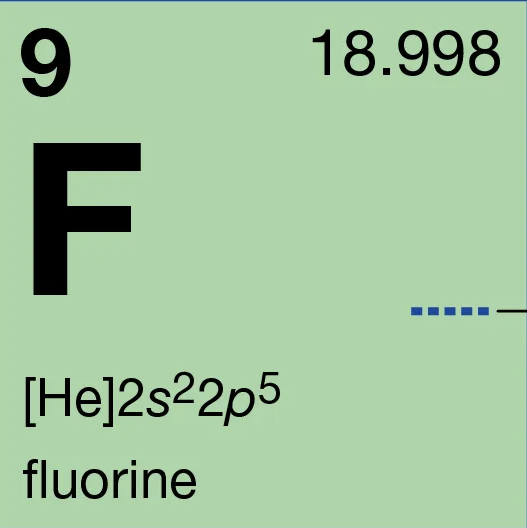

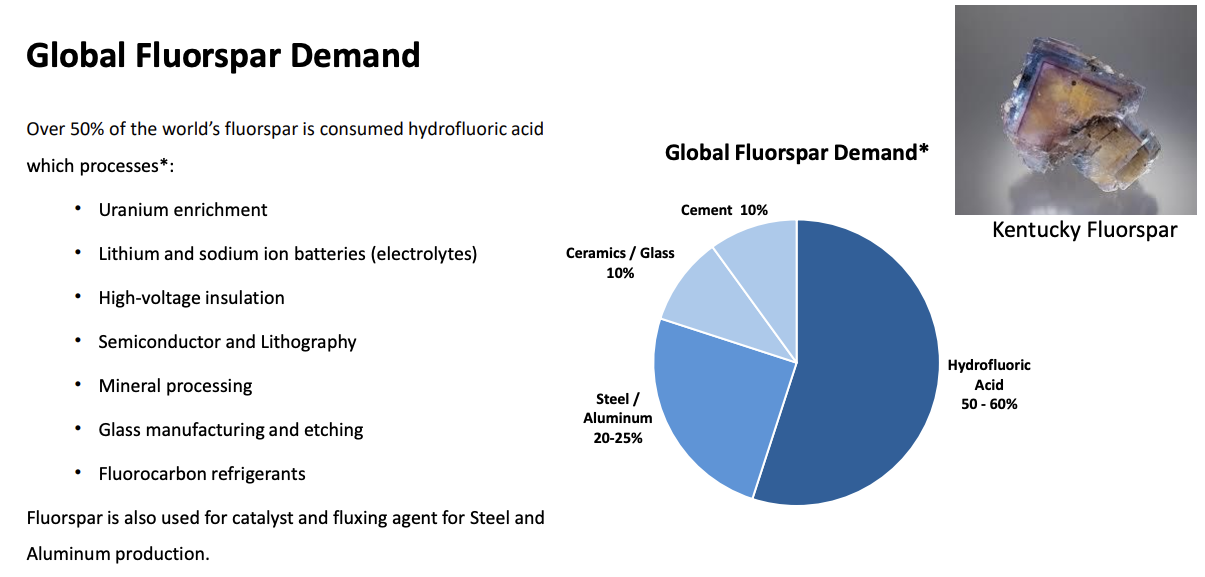

2% royalty on Kentucky-Illinois Fluorspar projects in USA, operated by CleanTech Vanadium Mining Corp. CleanTech’s Fluorspar Projects received over 745 historic drill holes, covering over 17,750 acres and collectively control key segments of the Illinois Kentucky Fluorspar District’s most productive fault systems. Oracle Commodity Holding portfolio owns 42.8M shares of CleanTech Vanadium, 30% of the outstanding shares of CleanTech Vanadium.

2% royalty on Kentucky-Illinois Fluorspar projects in USA, operated by CleanTech Vanadium Mining Corp. CleanTech’s Fluorspar Projects received over 745 historic drill holes, covering over 17,750 acres and collectively control key segments of the Illinois Kentucky Fluorspar District’s most productive fault systems. Oracle Commodity Holding portfolio owns 42.8M shares of CleanTech Vanadium, 30% of the outstanding shares of CleanTech Vanadium.

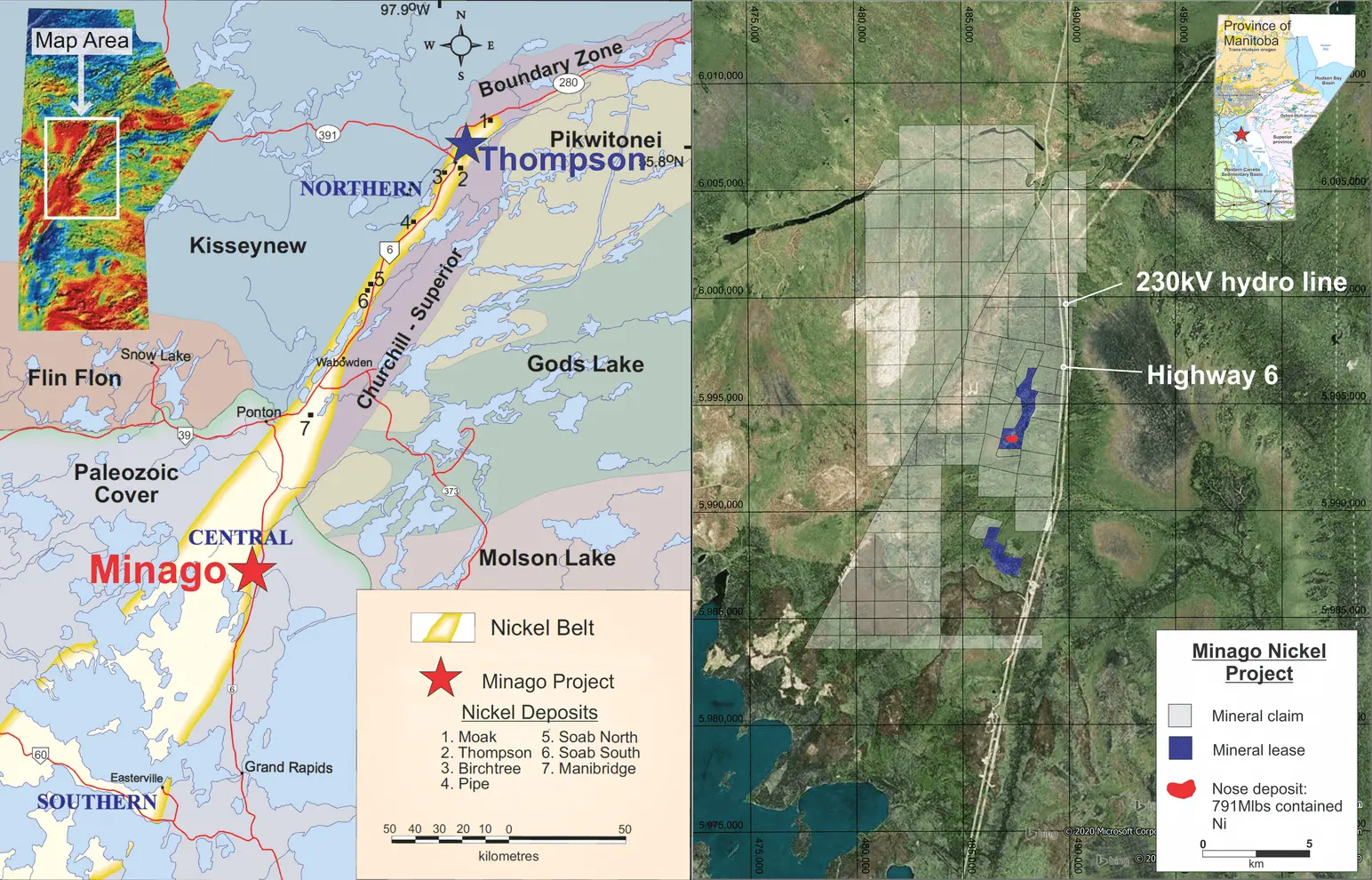

2% royalty on the Minago nickel PGM project in the Thompson nickel belt, Manitoba, operated by Norway House Cree Nation.

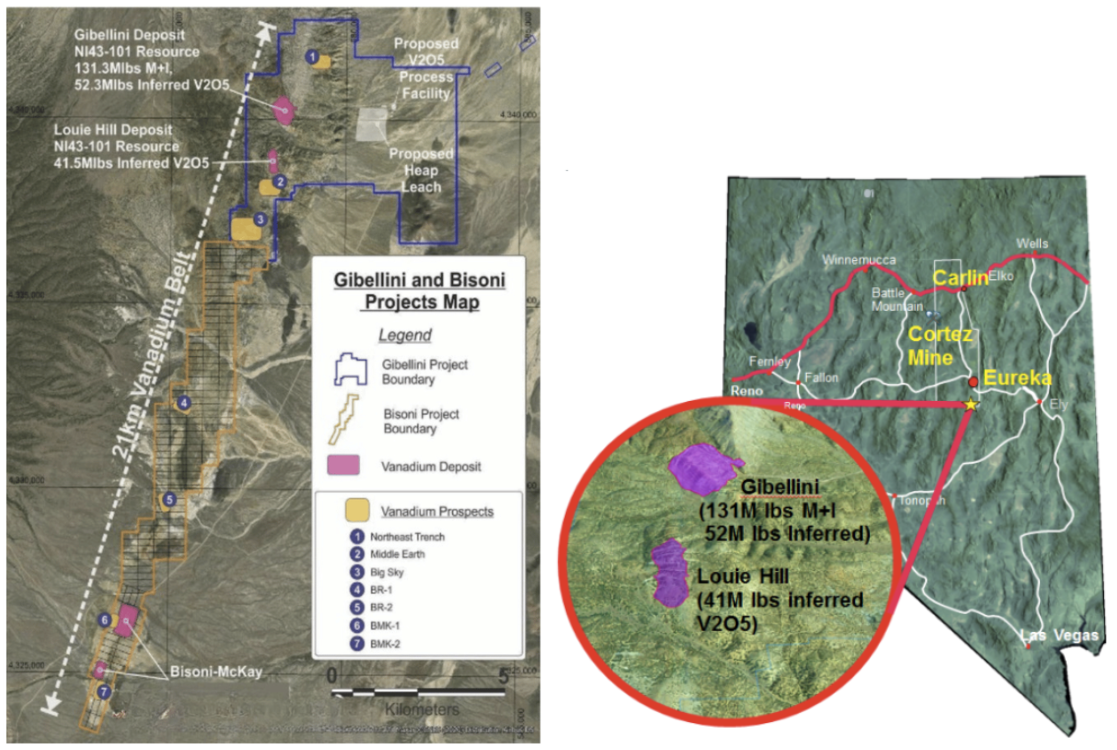

2% royalty on the Gibellini vanadium project in Nevada, operated by CleanTech Vanadium Mining Corp. On October, 23, 2023, the Bureau of Land Management (BLM), Battle Mountain District Office issued a positive Record of Decision and Plan of Operations approval for the Gibellini Vanadium Mine project in Eureka County, Nevada.

2% royalty on the Pulacayo-Paca silver-lead-zinc project in Potosi, Bolivia operated by Silver Elephant Mining Corp. (“Silver Elephant”). Pulacayo-Paca delivered 1.4 million oz of silver in 2024. A major portion of Pulacayo-Paca mining rights are under dispute pending appeal.

A certain royalty on the Ulaan Ovoo coal project in Mongolia as described in Silver Elephant’s news release dated Aug 29, 2025. This royalty generated approximately US$218,000 in income to Oracle in 2024.

Oracle Royalty Business Model

Oracle Featuring Silver Production

Oracle Commodity Holding Corp. (TSX-V: ORCL, OTCQB: ORLCF) is a mining royalty company spun out from Silver Elephant Mining Corp. (TSX: ELEF) in 2022.